Money after getting your salary will go away in just a few days, and you won't even realize. Groceries, rent, a school fee you forgot about, maybe a last-minute medical bill. And suddenly, saving feels impossible. If you've ever felt like you're working hard but not moving forward, you're not the only one.

That’s why the 50/30/20 rule is one such perfect ways to handle money wisely. It gives your money a clear direction without asking you to become a finance expert. Get a plan and save for the things you enjoy, and still are able to fulfill all your responsibilities.

What Is the 50/30/20 Rule?

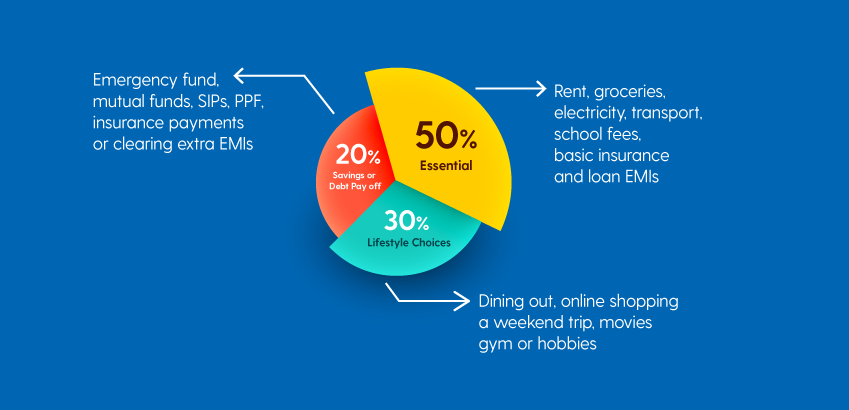

The 50/30/20 rule is one of the simplest ways to handle money wisely. It helps you divide your monthly income into three clear parts so you can manage spending without losing control. It’s a great first step for anyone learning how to have financial discipline.

50% for Essentials

This part covers the basic stuff. Think rent, groceries, electricity, transport, school fees, basic insurance, and loan EMIs. These are the costs you must cover to keep things going.

30% for Lifestyle Choices

This slice is for the things you enjoy but can live without. Dining out, online shopping, a weekend trip, movies, gym, or hobbies. You’re not cutting off the fun part of life, just giving it a boundary.

20% for Savings or Debt Payoff

This part is for giving your future a strong base. It’s where you put money aside for things like an emergency fund, mutual funds, SIPs, PPF, insurance payments, or clearing extra EMIs. When you save before you spend, you worry less and feel more in control down the road.

Why the 50/30/20 Rule Is Important

Most people either save whatever is left at the end of the month or don’t track their money at all. They pay bills, spend a little here and there, and hope things work out. But here’s the problem: this habit leaves your future up to chance.

The 50/30/20 rule changes that. It helps you to learn how to have financial discipline with your money using a clear direction without needing financial knowledge or complicated tools.

- It forces you to prioritize yourself first.

- It shows you how to stop living paycheck to paycheck.

- It helps you save consistently without overthinking it.

- It forces you to prioritize yourself first.

- It shows you how to stop living paycheck to paycheck.

- It helps you save consistently without overthinking it.

And the best part? It’s easy to remember and easy to follow. No need for apps unless you want them. Even a notebook works.

How to Put It Into Action

Knowing a rule is not enough unless you use it in your daily life. The 50/30/20 method is a simple plan, but it only works when you follow it consistently. If you're looking for practical ways to handle money wisely, here’s how you can break down your income and start managing your expenses better every month.

1. Start With Your Take-Home Pay

Don’t use your gross income. Use what lands in your bank after all deductions. That’s your real starting point.

2. Break It Down

Let’s say you earn ₹80,000 a month after tax. Divide it like this:

- Essentials: ₹40,000

- Lifestyle: ₹24,000

- Savings or Debt Payoff: ₹16,000

- Essentials: ₹40,000

- Lifestyle: ₹24,000

- Savings or Debt Payoff: ₹16,000

Ensure that you add all your loans, credit cards, and other bills at once for better clarity on expenses.

3. List What Belongs Where

If your Netflix, gym membership, and weekend takeout are taking over the Essentials zone, you’re fooling yourself. Keep your wants separate from what you must pay to stay afloat.

4. Set Automatic Transfers

Automate your savings right after payday. Put money into mutual funds, recurring deposits, or a savings account the same day your salary arrives. That way, you save first and spend what’s left, not the other way around.

5. Revisit Every Few Months

Your expenses won’t stay the same forever. Rents go up, income changes, and sometimes emergencies hit. Recheck your split every six months or so.

What If the Split Doesn’t Work for You?

Real life isn’t always this clean. Maybe you live in a metro city where rent alone eats up 40% of your income. Or your child’s school fee is unusually high. That’s okay. This rule is a starting point, not a strict order.

You can tweak the percentages. Go 60/20/20 or even 55/25/20 if that suits you better. The key is to know where your money is going and to make sure some part of it is being saved.

Mistakes You Might Make While Creating A Budget Plan

Even with the best intentions, budgeting can go wrong if not done carefully. Small errors can lead to big financial gaps over time. If you're trying to learn how to have financial discipline, it's important to avoid common budgeting mistakes.

Here are a few things people often get wrong while setting up their monthly plan and how you can fix them before they become habits.

1. Misclassifying Wants as Essentials

If your car EMI is high because you went for a luxury model, that’s not an essential—it’s a lifestyle choice. The same goes for eating out five times a week.

2. Skipping Savings

If you always wait until the end of the month to save, you probably won’t.

3. Ignoring Emergencies

Unexpected expenses are not optional. Health issues, job loss, urgent repairs can happen anytime. So, build an emergency fund with at least 3–6 months of your expenses. Use this rule to make that happen.

4. Not Checking Frequently

What worked last year might not work this year. Maybe your income grew or your rent dropped. So, change your numbers as your situation changes.

Other Budgeting Ways You Can Use

If you outgrow the 50/30/20 rule, here are some others worth trying:

Zero-Based Budgeting

Every rupee is given a job. You plan for everything in advance. However, it will take more effort and gives you full control of your savings.

Envelope System

Withdraw cash, place it into envelopes for different categories, and spend only what’s inside. When the envelope is empty, spending stops.

Pay Yourself First

Put a fixed amount into savings first. Then manage everything else with what’s left.

These methods can be combined. For example, use the 50/30/20 split, but also pay yourself first.

Small Changes You Must Make

- Adjust bill due dates to match your payday. It helps you avoid missing payments.

- Track your expenses once a week. It takes 10 minutes and helps you spot leaks early.

- Set up a reminder every three months to review subscriptions and auto-renewals.

- Give your budget categories names that excite you. Call your savings account "Dream Trip" or "Freedom Fund." It makes saving feel better.

- Adjust bill due dates to match your payday. It helps you avoid missing payments.

- Track your expenses once a week. It takes 10 minutes and helps you spot leaks early.

- Set up a reminder every three months to review subscriptions and auto-renewals.

- Give your budget categories names that excite you. Call your savings account "Dream Trip" or "Freedom Fund." It makes saving feel better.

Final Thoughts

The 50/30/20 rule helps you create a plan you can actually follow, without turning into a number-obsessed robot. Start with this rule. Give it two to three months. Watch how your money behaves. Then adjust as your income or priorities change.

You don’t need to cut all the fun from your spending. You just need to give your money a clear direction. Start small. Stay honest. And most of all, make your money work for you, not the other way around.

Want to turn your financial awareness into income?

Become a certified loan agent with Choice Connect. No high qualifications needed. Just your smartphone and your time.

FAQs

1. Can I still use the 50/30/20 rule if my income is irregular or seasonal?

Yes, but you’ll need to tweak it. Instead of using monthly income, calculate your average earnings from the last 3 to 6 months. Use that number as a baseline. When you earn more, stash the extra in your savings bucket. When income dips, you’ll already have a buffer.

2. What if I live in a high-rent city where 50% doesn’t cover basic living?

If your fixed costs like rent and utilities already cross 50%, don’t panic. It just means your “Needs” section might temporarily go up to 60% or 70%. The key is to then cut down a bit on “Wants” and keep saving at least 10% if 20% isn’t possible.

3. Can I follow this rule if I have multiple loans or EMIs?

Absolutely. Just include your loan EMIs under the 20% savings/debt section. If your loans take up more than that, focus on reducing “Wants” until the debt is under control. Over time, as EMIs reduce, you can shift that extra money back into savings.